Domestic Business

Despite challenging market conditions amid the spread of COVID-19, the Korean life insurance market recorded KRW 119.6 trillion in direct premiums in 2020, up 2% from the previous year. At the beginning of the year, the life market got off to a relatively good start, with sales of protection policies growing fast. However, COVID-19 brought the economy to a standstill, curbing private consumption and having an impact on insurance market growth. From halfway through the year, the market started to recover to some degree, backed by sales of health and savings insurance products.

Protection life insurance showed a growth of 4.1%, driven by rising demand for health insurance products and last-minute purchases before insurers cut their estimated interest rates. Savings-type insurance premiums grew by 9.8% as sales of short-term savings insurance products increased due to widening gaps between interest rates on bank deposits and crediting rate on insurance products.

Korean Re reported gross premiums of KRW 925 billion for the domestic life and health (L&H) business in 2020, representing a 0.8% decline from the previous year. The slight decrease came in spite of our continued effort in joint product development with direct insurers to drive new business growth. The primary reason for the contraction was portfolio adjustments – a strategic reduction of loss-making or low margin treaties. Accordingly, our net underwriting results improved by KRW 10.8 billion to KRW 25.9 billion in 2020.

Our market share is estimated to have decreased slightly to around 40% in 2020. The domestic life reinsurance market increased by 8.4% to KRW 2,266.5 billion in 2020 on the back of primary insurance market growth.

In 2021, the life insurance market in Korea is expected to see an increase in premium income by 3.5% from the previous year. Premium growth of protection insurance will likely slow down to 2.9% due to a continued decline in demand amid economic woes and an aging population. Stronger regulations of market conduct may also pose some challenges to insurers in their efforts to drive premium income growth. Savings insurance premiums are expected to decline by 2.7% on the base effect of growth in 2020.

Along with a prolonged COVID-19 pandemic, the life insurance market will be facing a set of challenges: difficulties in traditional agent channel sales, the implementation of new regulations to modify the structure of low/no surrender value insurance products, changes to the commission scheme, and preparations for a soft landing in the introduction of IFRS 17. Life insurers also need to address longer-term challenges such as declining demand for death benefit products against the backdrop of increasing life expectancy and potential diversification of sales channels in tandem with the spread of so-called “untact culture” where technologies reduce the need for person-to-person interaction, allowing people to increasingly interact online.

In response to this changing business environment, our Domestic Life & Health Team will strive to stay ahead of all these changes. We will strengthen our expertise in providing risk management solutions to direct insurers through the newly introduced coinsurance business and supporting them under the upcoming IFRS 17 regime. We will also remain strongly committed to working with life insurers on the development of new health insurance products, while making sure that stable reinsurance capacity is provided with regard to simplified issue products and high-death-benefit life insurance.

In doing so, nothing is more essential than identifying client needs accurately. Korean Re will continue to engage closely with direct insurers to figure out the best way to serve them and actually deliver the underwriting services that meet their needs. The reinsurance training programs and underwriting seminars that we provide regularly are another important means of client engagement. These efforts to ensure the success of our clients will also ensure the success of Korean Re as the leading reinsurer in the Korean life insurance market.

Gross Written Premiums: Domestic Life and Health

(Units: KRW billion, USD million)

| FY 2020 (KRW) | FY 2020 (USD) | FY 2019 (KRW) | FY 2019 (USD) | |

| Domestic Life and Health | 925.0 | 776.2 | 932.3 | 792.4 |

Overseas Business

In 2020, the life reinsurance markets across the globe were significantly affected by an unprecedented health crisis arising from COVID-19. A number of leading life reinsurers suffered profit setbacks, driven particularly by heavy losses from elevated mortality claims in the U.S.

Despite this global pandemic situation, our overseas L&H business enjoyed a successful 2020 in terms of growth. We reported a 17.5% increase in gross written premiums to KRW 541.2 billion for the year. The major driving force was the growth of our business in North America and Latin America.

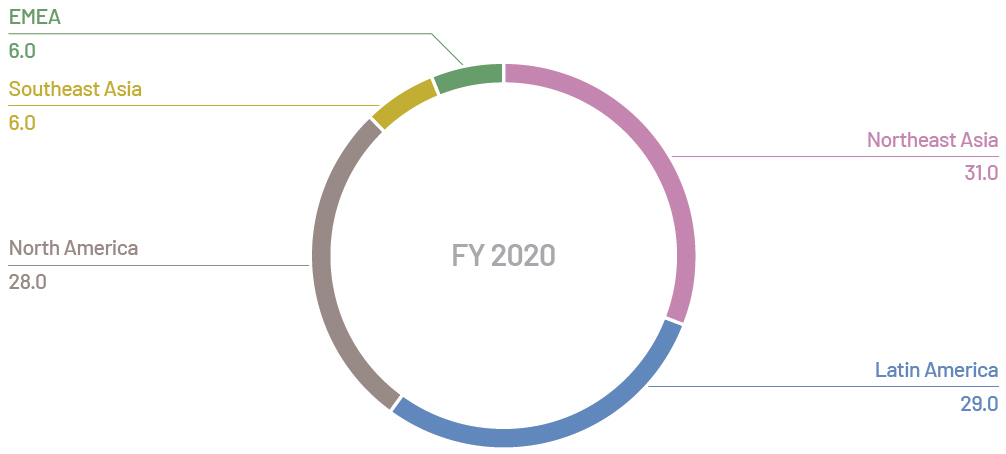

Our premium income portfolio by geography shows that Northeast Asia accounted for the largest share of our overseas L&H business at 31%, followed by Latin America and North America at 29% and 28%, respectively. We achieved remarkable business growth in Latin America, with premiums soaring by 110% in 2020 compared to the previous year. This clearly demonstrates that our relentless endeavors to diversify the portfolio paid off. Europe, the Middle East and Africa (EMEA) and Southeast Asia took up 6% each.

The portfolio rebalancing efforts will continue into 2021 in accordance with our profit-oriented growth strategy. To this end, we will keep working to increase the portions of non-proportional and group businesses. We will also seek to build strategic alliances with new clients as well as strengthen relationships with our existing clients and partners. Combined with these efforts, we expect to benefit from improved mortality rates in the coming years.

As evolving regulations and a persistently low interest rate environment drive demand for non-traditional reinsurance, we believe it is now more important than ever to dedicate ourselves to offering innovative solutions that can help reduce the required capital of insurers. We at Korean Re clearly understand the role we need to play in supporting our clients with optimizing their risk-based capital in a way that helps them meet their regulatory requirements and ensure their business growth. We are committed to living up to that role, which in turn may provide new business expansion opportunities for our company.

Gross Written Premiums: Overseas Life and Health

(Units: KRW billion, USD million)

| FY 2020 (KRW) | FY 2020 (USD) | FY 2019 (KRW) | FY 2019 (USD) | |

| Asia | 200.8 | 168.5 | 222.0 | 188.7 |

| Americas | 307.7 | 258.2 | 205.7 | 174.8 |

| EMEA | 32.7 | 27.4 | 32.8 | 27.9 |

| Total | 541.2 | 454.1 | 460.5 | 391.4 |

International Portfolio by Geography

(Unit: %)