Domestic Business

In 2020, the Korean property insurance market was severely impacted by unprecedented large loss events. They included the Lotte Chemical plant explosion, the leakage at a pumped storage hydroelectric power plant of Korea Hydro & Nuclear Power and a series of losses involving LG Chemical. Furthermore, heavy rainfalls during a record-long monsoon season from July through August and Typhoons Maysak and Haishen in September took a heavy toll on market profitability. As a result, the loss ratio of the property insurance market soared from 47.6% in 2019 to 143.8% in 2020. This was the worst loss ratio in the last 20 years.

In terms of market growth, premium income expanded by 9.0% to KRW 1,923 billion in 2020. This solid growth was mostly driven by an increase in comprehensive insurance premiums, which grew by 13.7% to KRW 1,698 billion. The fire insurance market, on the other hand, continued to show a downward trend, with premiums decreasing by 16.8% to KRW 225 billion.

As the market experienced a series of large and catastrophe losses, primary insurers have become more cautious about retention, relying more on reinsurance capacity. The retention ratio of primary insurers went down from 48.8% in 2019 to 45.1% in 2020. This trend has resulted in market hardening, increased rates and strengthened underwriting guidelines in the primary market.

Thanks to the favorable rating environment and greater dependency of primary insurers on reinsurance, Korean Re’s domestic property business saw its premium income increase by 11.2% to roughly KRW 528 billion in 2020. Premium income from fire insurance rose by 9.1% to KRW 107 billion, while premiums from comprehensive insurance increased by 11.7% to KRW 420 billion. However, our underwriting performance was heavily impacted by large and catastrophe losses, with the combined ratio before management expenses going up by 30.6%p to 109.7%.

In 2021, our focus will remain on improving profitability. In order to do so, we have tightened our underwriting guidelines for both facultative and treaty businesses. Considering the economic downturn caused by COVID-19, higher rates and deductibles have been imposed on renewal accounts, and we make sure that this applies more strictly to economy-sensitive risks such as warehouses. Risks that require higher standards of management such as petrochemical and power plants are also being handled with increased underwriting discipline.

For treaty renewals in 2021, we have continued our focus on strengthening reinsurance terms and conditions by inserting the Communicable Disease Exclusion, reducing commission rates and minimizing exposure to risks that are sensitive to the economy and prone to natural catastrophes, including warehouse and home insurance risks. We will continue to exercise highly disciplined underwriting in order to build a profit-oriented portfolio and drive improved underwriting performance throughout 2021 and beyond.

Gross Written Premiums: Domestic Property Business

(Units: KRW billion, USD million)

| FY 2020 (KRW) | FY 2020 (USD) | FY 2019 (KRW) | FY 2019 (USD) | |

| Fire | 107.3 | 90.0 | 98.3 | 83.6 |

| Comprehensive | 420.4 | 352.8 | 376.3 | 319.8 |

| Total | 527.7 | 442.8 | 474.6 | 403.4 |

International Facultative Business

It was another year of profitable growth in 2020 for our international property facultative business. We achieved a 13.7% increase in our book of business, with gross written premiums reaching KRW 123.5 billion. The combined ratio before management expenses went noticeably down to 62.0% in 2020 from 91.3% in 2019.

These outstanding results were driven by our ongoing efforts to take customized approaches to underwriting guidelines for different regions. We have continuously tightened our underwriting guidelines to minimize exposure in catastrophe-prone areas. We have also increased our participation in proportional reinsurance programs with strong track records of profitability. The portfolio restructuring that we have sought over the past years also helped us improve our bottom-line results.

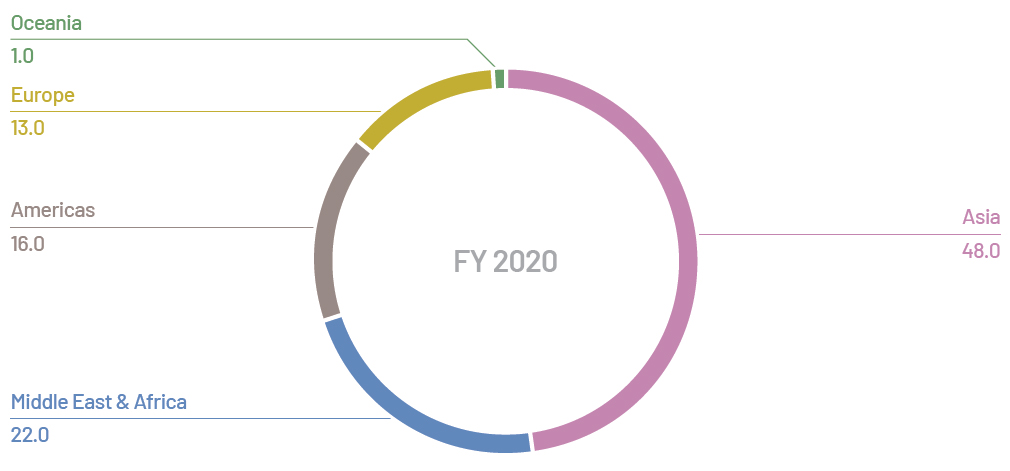

Meanwhile, the strategic initiative to grow our book of business in less developed territories has contributed a great deal to the increase in gross written premiums. In terms of premium breakdown by territory, 48% of the entire international property facultative business came from Asia in 2020.

This means that the Asian region is still our biggest market, followed by the Middle East and Africa (22%), the Americas (16%), and Europe (13%). While our commitment to serving the Asian market remains as solid as ever, we will strive to expand our business in other regions, further diversifying our geographical business portfolio. The expansion of business will be accompanied by meticulous risk assessment to identify the target markets that are worth further tapping into.

The remarkable achievements we made over the past year let us head into 2021 with a bit of optimism and confidence in terms of our business prospects. Although there are some factors that may put our business on a risky path, such as how the pandemic situation will evolve, an unexpected regulatory intervention, and any catastrophe losses, we are positive that we will remain steady to support our clients on the back of our strong credit ratings, sufficient capacity and underwriting expertise. We will continue to leverage those strengths to deliver long-term growth for our company and create value for our clients and business partners going forward.

Gross Written Premiums: International Facultative Business

(Units: KRW billion, USD million)

| FY 2020 (KRW) | FY 2020 (USD) | FY 2019 (KRW) | FY 2019 (USD) | |

| International Facultative | 123.5 | 103.6 | 108.6 | 92.3 |

International Facultative Portfolio by Geography

(Unit: %)

International Treaty Business

In 2020, global insured losses derived from natural disasters reached USD 97 billion, representing an increase of 26% compared to the previous year. It marked the fifth costliest year on record behind 2017, 2011, 2005, and 2018. Insured losses were dominated by events that occurred in the U.S., and the largest insured loss event for the season was Hurricane Laura, which was estimated to cost insurers USD 10 billion.

Due to record-setting hurricane landfalls in the U.S. and COVID-19 loss experience in Europe, January 2021 renewals for these markets witnessed a few signs of market hardening.

In 2020, we continued to place a great deal of focus on portfolio management to get our international treaty business back on track to a profitable position. Active portfolio management led to a decrease in unprofitable proportional business. As a result, our book of business shrank by 7.6%, with gross written premiums standing at KRW 537.6 billion in 2020.

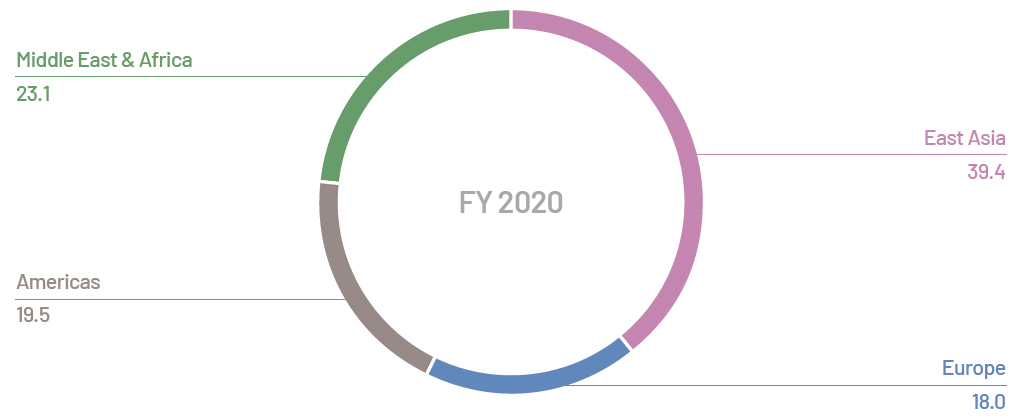

Geographically, East Asia still made up the largest portion of our international treaty portfolio at 39.4%, followed by the Middle East and Africa at 23.1%, the U.S. at 19.5%, and Europe at 18.0%. The portions of East Asia and Europe were slightly adjusted downward due to the reassessment of certain large proportional accounts and portfolio transfers to our overseas subsidiary and branch. Meanwhile, there was an increase in the portions of the Middle East and Africa, and the U.S. The overall picture was well in line with our strategy to pursue growth only when it is supported by stable bottom-line prospects.

The COVID-19 pandemic has presented a huge challenge to reinsurers across the world, and it will take many years to fully understand the impact of the pandemic on the reinsurance markets in different regions. At Korean Re, we had our share of losses due to increased claims experience, but the losses related to COVID-19 events contributed about 3.4%p to the combined ratio before management expenses, which remained quite controlled and manageable compared to other reinsurers.

In 2021, we will seek sustainable growth in target regions and continue to optimize our portfolio in a way that ensures stable business results and helps us manage the volatility of catastrophe losses. As in 2020, effective portfolio management will remain an important initiative to put our overseas property treaty business on a stronger footing.

Gross Written Premiums: International Treaty Business

(Units: KRW billion, USD million)

| FY 2020 (KRW) | FY 2020 (USD) | FY 2019 (KRW) | FY 2019 (USD) | |

| East Asia | 211.9 | 177.8 | 236.2 | 200.8 |

| Middle East & Africa | 124.0 | 104.1 | 113.8 | 96.7 |

| Europe | 96.9 | 81.3 | 111.7 | 95.0 |

| Americas | 104.8 | 87.9 | 120.1 | 102.1 |

| Total | 537.6 | 451.1 | 581.8 | 494.5 |

✽ Individual figures may not add up to the total shown due to rounding.

International Treaty Portfolio by Geography

(Unit: %)